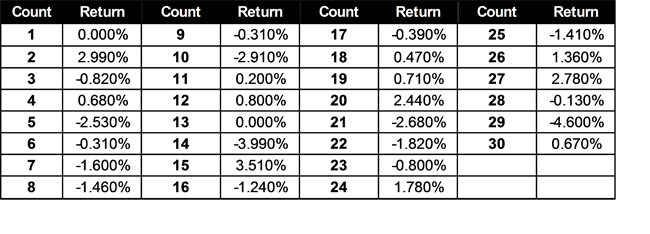

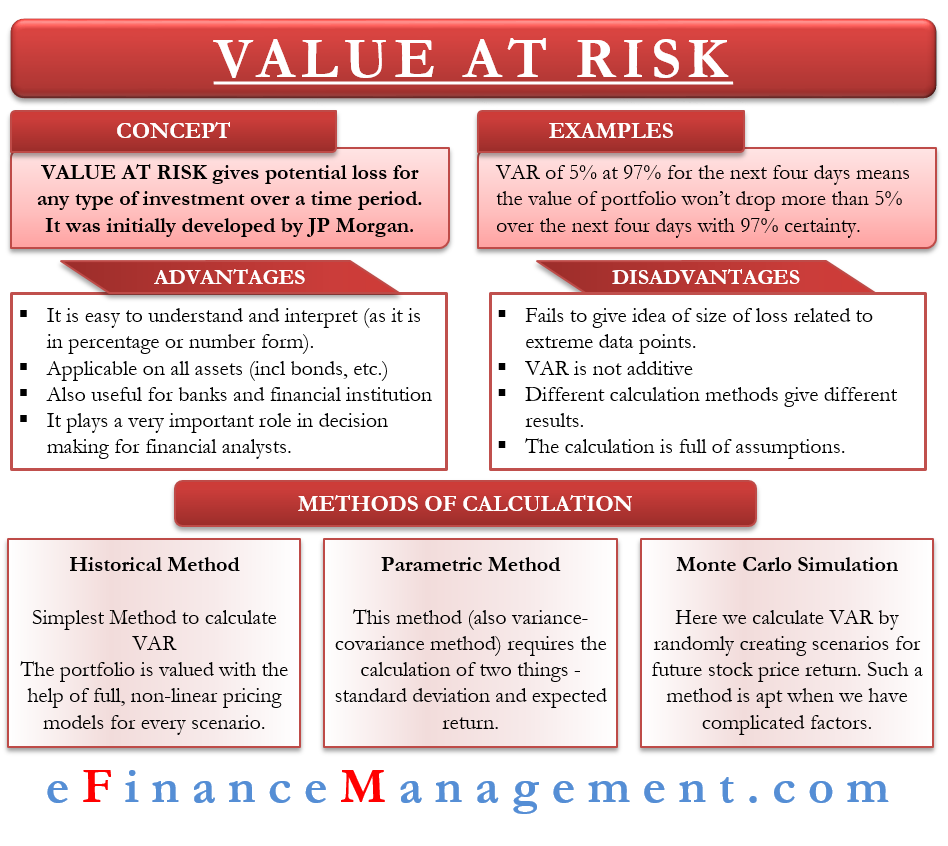

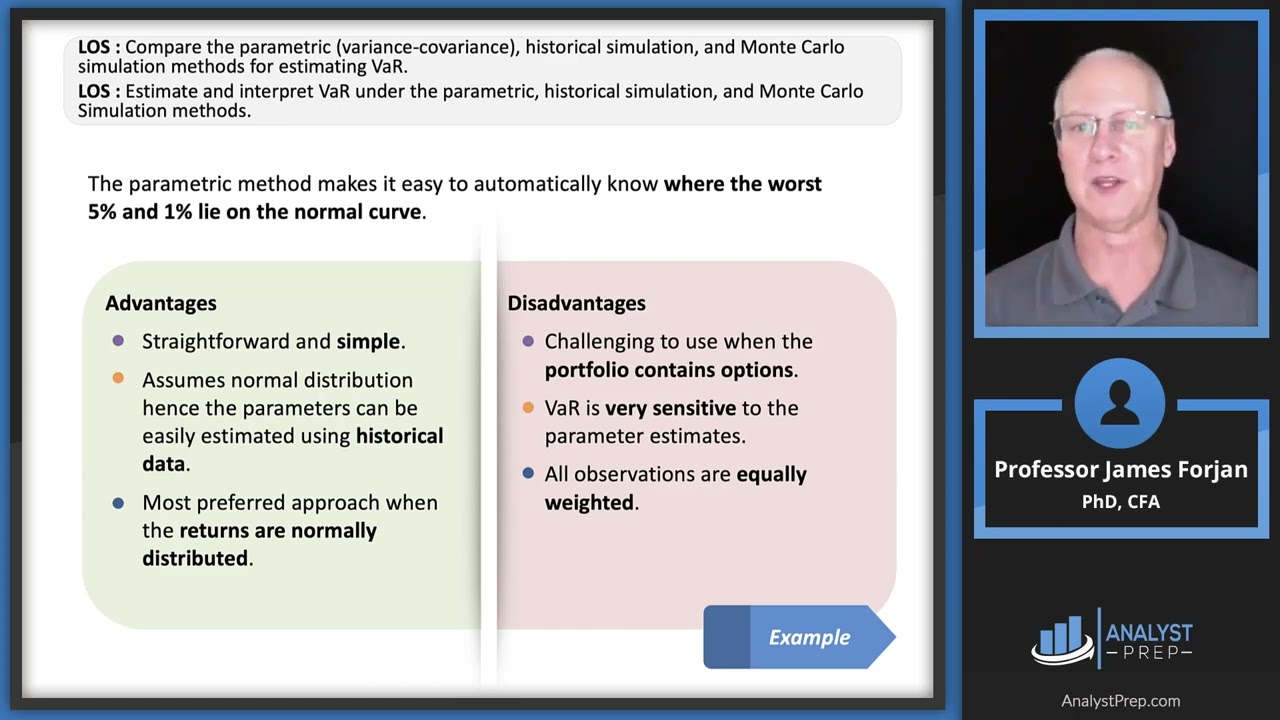

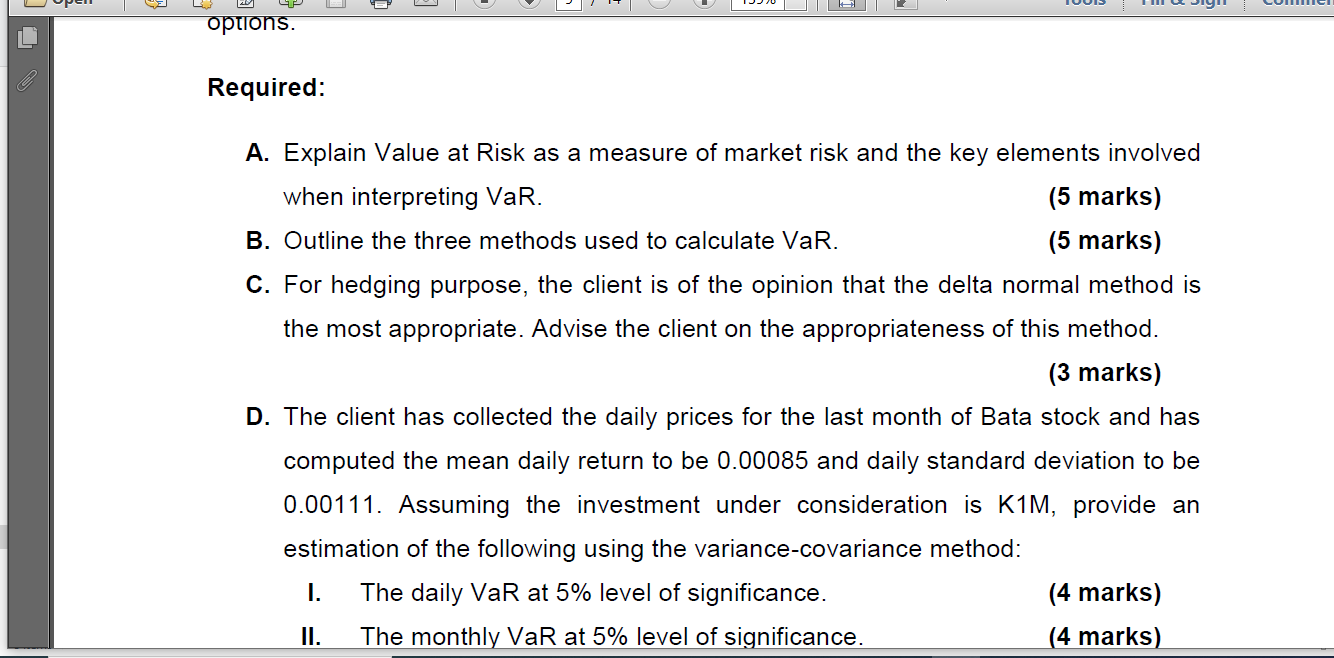

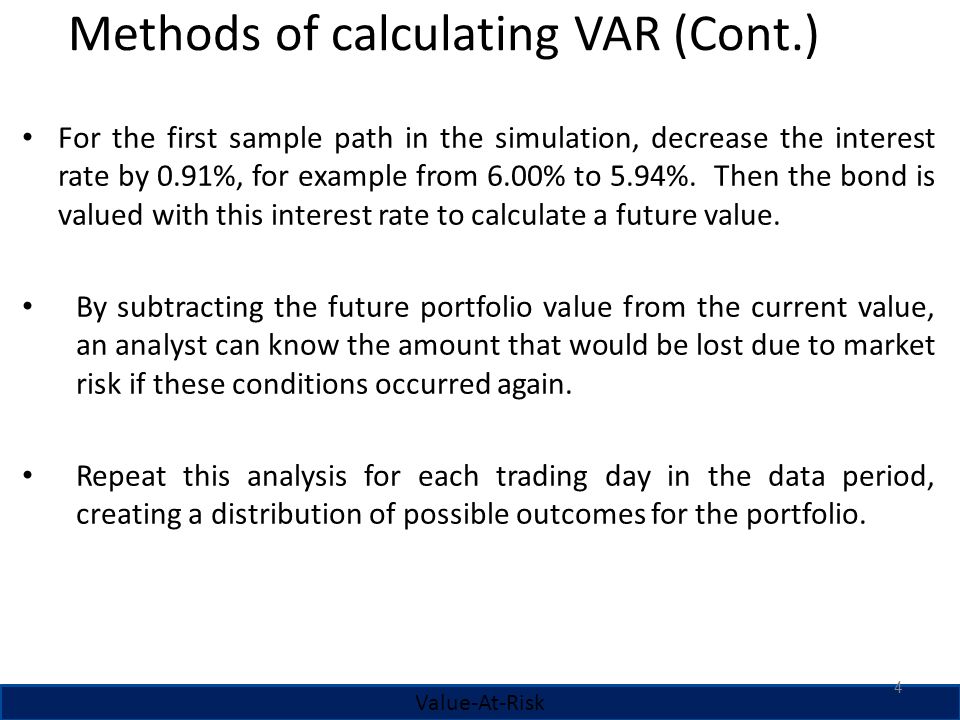

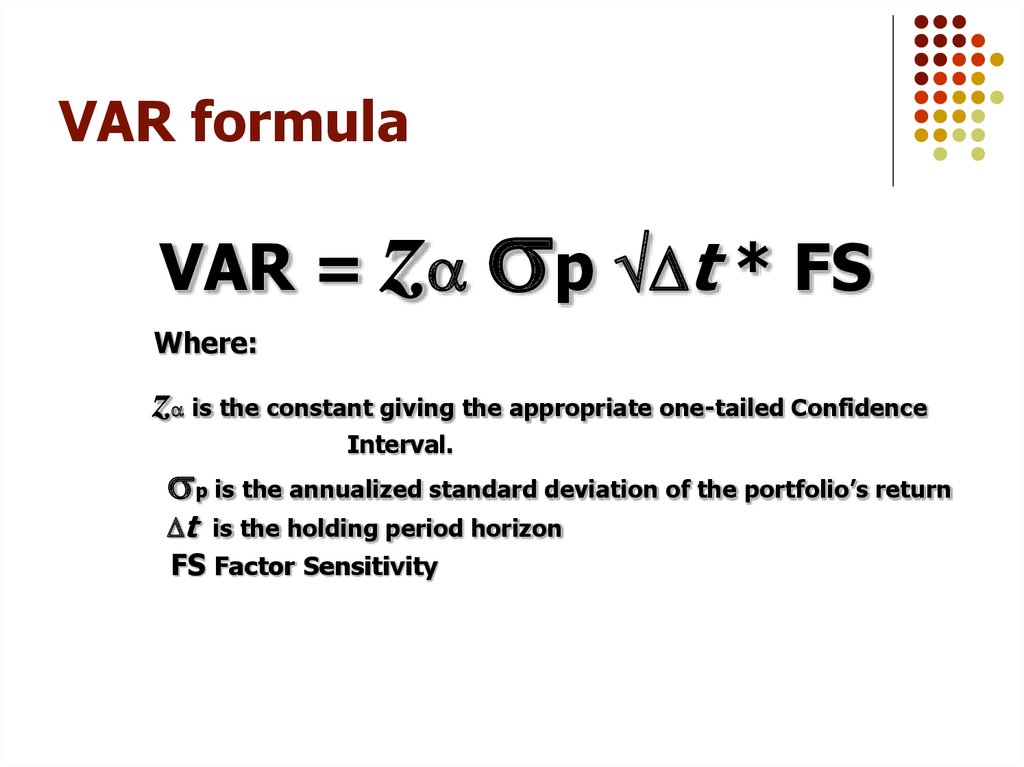

SOLVED: Required: A. Explain Value at Risk as a measure of market risk and the key elements involved when interpreting VaR. (5 marks) B. Outline the three methods used to calculate V

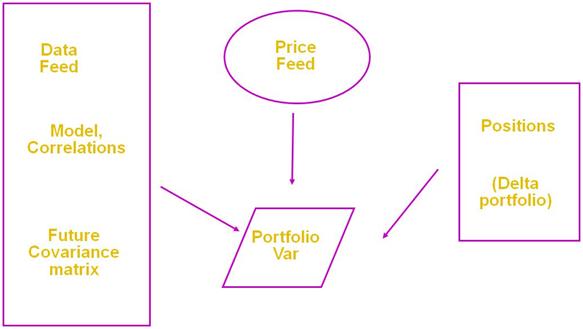

Steps required to update scenarios and calculate the VaR using the GP... | Download Scientific Diagram

:max_bytes(150000):strip_icc()/dotdash_final_How_To_Convert_Value_At_Risk_To_Different_Time_Periods_Dec_2020-02-5aca0db5025b4c10a2f15f4f5f1daf7a.jpg)

:max_bytes(150000):strip_icc()/dotdash_final_How_To_Convert_Value_At_Risk_To_Different_Time_Periods_Dec_2020-01-1a98d3db75024bbdac410a3be7185859.jpg)

:max_bytes(150000):strip_icc()/dotdash_final_How_To_Convert_Value_At_Risk_To_Different_Time_Periods_Dec_2020-03-32667770c8a14b3a8f5e4be0fd96035e.jpg)